Determine whether a property will make a sound investment opportunity in a matter of minutes.

Property Analyser is included in our Starter, Professional and Advanced Memberships.

To see the full steps on how to complete all the fields in Property Analyser, please watch the video below.

You will have the option to click Edit future years forcasts for your property analysis, this will allow you to make changes to the following fileds for each year:

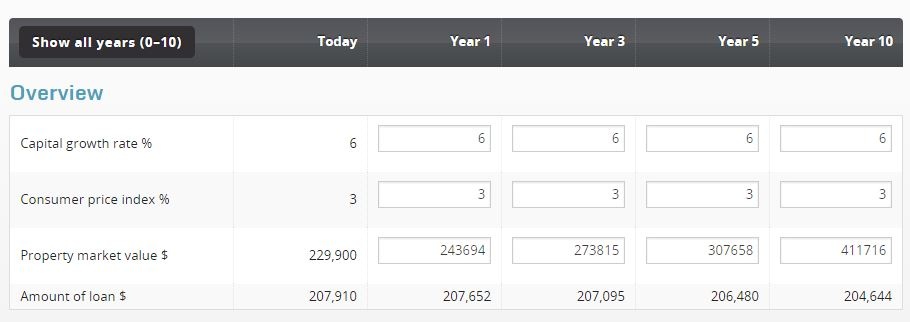

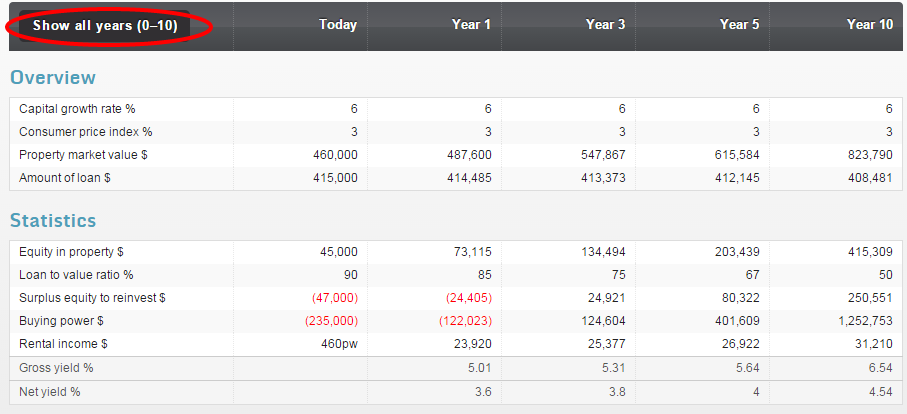

The report will default to display years 1, 3, 5 and 10 however you have the option to click Show all years (0-10) which will then display the full forecast from years 1 to year 10 inclusive.

You can re-select Show only years 1, 3, 5 & 10 if you wish to.

Click Move to Portfolio Tracker at the top of the Property Analyser report.

![]()

Learn more with this quick video

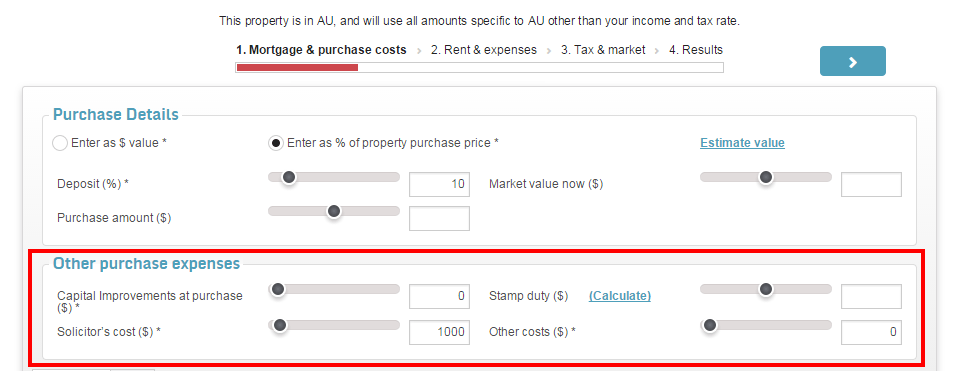

Capital improvements at purchase ($) - enter the amount for any capital improvements (renovations or repairs) you plan on doing after the property purchase (e.g. new kitchen or painting).

Stamp duty ($) - enter the payable stamp duty amount here, if you don't know the amount click on Calculate to launch the calculator to get an estimate click on add to analysis.

Solicitor's cost ($) - enter your legal and/or conveyancing fees (including disbursements).

Other costs ($) - enter any other costs that are not covered under any other section that you want to allow for (e.g. building & pest inspections).

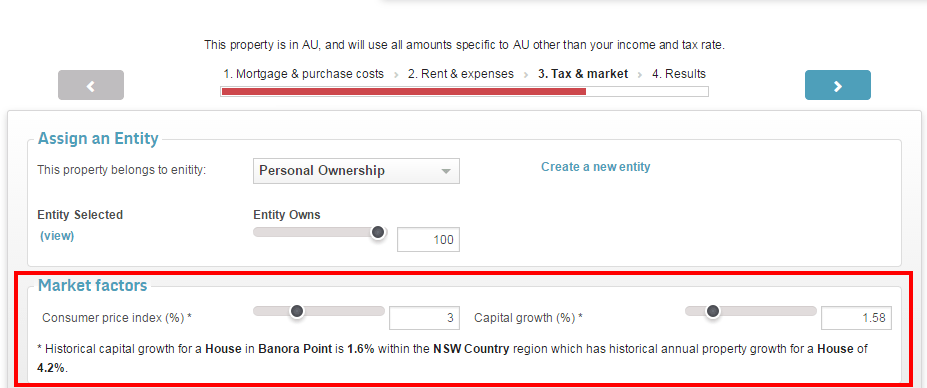

Market factors relate to the inflationary factors in the general price level of goods and services in an economy over a period of time.

You can use the sliders or type in the box provided.

Consumer price index (%) - Insert the CPI (Consumer Price Index %) as this governs the average rate of inflation that you will experience in relation to costs. This impacts the % by which your rental income and property expenses will increase each year if they move up in line with inflation. This figure can be obtained from the Australian Bureau of Statistics or Reserve Bank of Australia websites.

Capital growth (%) - Enter the average rate of annual capital growth you expect to achieve over the long term. This affects the rate at which your property will increase in value each year and impacts your increased equity in the property. This figure can be estimated based on historical performance of a suburb which can be obtained from the Suburb Flyover Report.

The amount of depreciation you may be able to claim depends on many factors, including your property's age, quality of construction and your income bracket.

The estimate is generated from Washington Brown and they use comparable depreciation calculations to generate an estimate. In some cases where there haven't been reports completed for similar properties, this can also cause a $0 result.

Property Analyser is included in all of our plans.

E-mail Address

Australia: info@realestateinvestar.com.auE-mail Address

New Zealand: info@realestateinvestar.co.nzAddress

333 George St, Sydney NSW 2000.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)

![]()

Real Estate Investar is part of MRI Software. We provide the tools, data and information you'll need to create wealth through property investment.