Renovation Budget Calculator

Keep your renovation on track with our free budget calculator Download Free

Renovation Budget Calculator

Keep your renovation on track with our free budget calculator Download Free

If you have bought an investment property, no matter the age, there might be an opportunity for you to claim tax deductions based on depreciable aspects of the property.

Buy a Depreciation Report NowIf you have an investment property and are not currently claiming depreciation, you're missing out. Depreciation means you can claim the cost of owning and maintaining your property against its value and get the difference back on your tax returns!

We also promise to save you twice the cost of the report in the first year or the report will be free. This guarantee is based on the tax deduction calculated 12 months from your settlement date. Our partners at Washington Brown will ensure your future tax savings warrant the purchase of the depreciation report, or you will receive a full refund.

It's risk free!

Benefits:

We promise to save you twice our fee in the first year or the report will be free. This guarantee is based on the tax deduction calculated 12 months from your settlement date.

*Disclaimer: Values shown in this summary are estimates only. All care has been taken to provide figures that are as accurate as possible. Washington Brown will contact you to ensure your future tax savings warrant the purchase of the depreciation report, or you will receive a full refund.

Once we have this information our customer service team will promptly forward you a detailed quotation, application and sample report via email. We guarantee you will save twice your fee or it's free!

Just like you claim wear and tear on a car purchased for income producing purposes, you can also claim the depreciation of your investment property against your taxable income.

There are two types of allowances available: depreciation on Plant and Equipment, and depreciation on Building Allowance.

Plant and Equipment refers to items within the building like ovens, dishwashers, carpet & blinds etc. Building Allowance refers to construction costs of the building itself, such as concrete and brickwork.

Both these costs can be offset against your assessable income.

You only need one depreciation schedule for each property that you own.

You should get a depreciation report commissioned as soon as possible after buying a property so that you can maximise the depreciation benefits that your Accountant can claim for you as part of your annual tax return.

Once the report is done and your Accountant has set up the asset values and depreciation schedules in your accounts the depreciation for each year can be calculated without needing to get any further deprecation reports for that property.

Simple. A depreciation schedule will help you pay less tax. The amount the depreciation schedule says you claim effectively reduces your taxable income.

Depreciation is known as a "non-cash deduction" because it's the only deduction that you don't have pay for on an ongoing basis. The deductions are in-built within the purchase price of your property.

Your depreciation report will cost $715 including GST.

Each property is different and many varying factors must be considered when preparing a property depreciation schedule. With this in mind, please use the Depreciation Calculator to give you an estimate of potential deductions.

Absolutely. Our partners at Washington Brown offer to save you twice their fee in the first year or the report will be free. This guarantee is based on the tax deduction calculated 12 months from your settlement date.

The Australian Institute of Quantity Surveyors (AIQS) Code of Practice stipulates that site inspections are necessary to satisfy ATO requirements.

Washington Brown's trained quantity surveyors ensure all depreciable items are noted and photographed. This guarantees you won't miss out on any deductions. The documentation can then be used as evidence in the event of an audit.

Your depreciation schedule will take approximately 2-3 weeks to complete, as long as your property can be inspected without delay. In some cases, you can order a priority service at an additional charge.

The simple answer is no. If your residential property was built after the 16th of September 1987 you will be able to claim both Building Allowance and Plant and Equipment. If construction on your property commenced prior to this date, you can only claim depreciation on Plant and Equipment (i.e. carpet, blinds, ovens etc). But it will still be worthwhile.

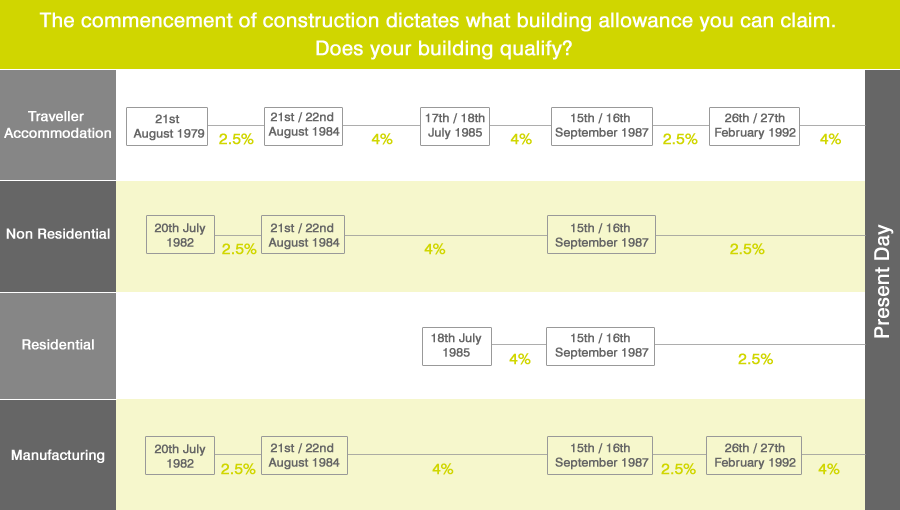

Depreciation rate time-line

Yes you can. Your accountant can amend your previous tax returns up to two years back. There are some exceptions so please contact your tax agent or the ATO for clarification.

If your residential property was built after 1985 your accountant is not allowed to estimate the construction costs. Tax Ruling 97/25 issue by the Australian Taxation Office (ATO) has identified Quantity Surveyors as properly qualified to make the appropriate estimate of the construction costs, where those costs are unknown.

Real estate agents, Property Managers, Accountants and Valuers are not allowed to make this estimate.

Chief Executive Officer of the Australian Institute of Quantity Surveyors (AIQS), Terry Aulich, advises that, whereas accountants can offer advice around other aspects of tax depreciation, construction costs and property depreciation are highly technical domains in their own right.

You, and your accountant if you wish, will be emailed a copy of the report. Additional fees will apply if you wish to receive a hard copy.

The simple answer is you can claim depreciation in the same way as you can if you bought a property here.

A great guide to learn about what you can and can't do is a publication from the ATO called Tax-smart investing: What Australians investing in overseas property need to know.

The depreciation laws work exactly the same. That is the building allowance only applies to property built after 1985.

The obvious barrier to claiming depreciation on overseas property is working out the construction cost and the expense associated with flying a Quantity Surveyor, to America for instance, to calculate the construction cost.

Washington Brown has affiliations in certain parts of the world so if you have bought a property, don't miss out on what you can legally claim.

Copyright © Real Estate Investar Australia Pty Ltd Privacy.